Tejon Ranch Co. (TRC)

Stock price: $16.14

Market Cap: $433M

Shares outstanding: 26.8M

Tejon Ranch Co. (TRC) is easily worth multiples of its current market capitalization, but a low-grade management team has hindered it for decades. A few astute fund managers have voiced their concerns regarding corporate governance and are looking for more investors to join them.

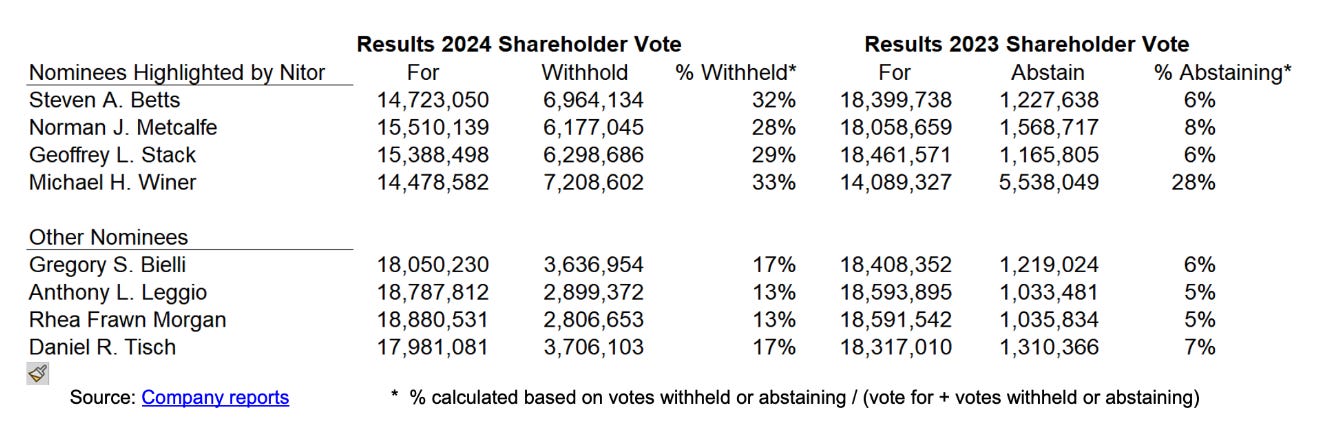

Given the exponential increase in withheld votes by TRC shareholders for directors at the latest annual meeting, an upcoming CEO departure, and a decent likelihood of an additional strategic investor, I believe Tejon Ranch Co. is arriving at an inflection point, and therefore find the company’s shares to be a sufficient long-term investment.

The business

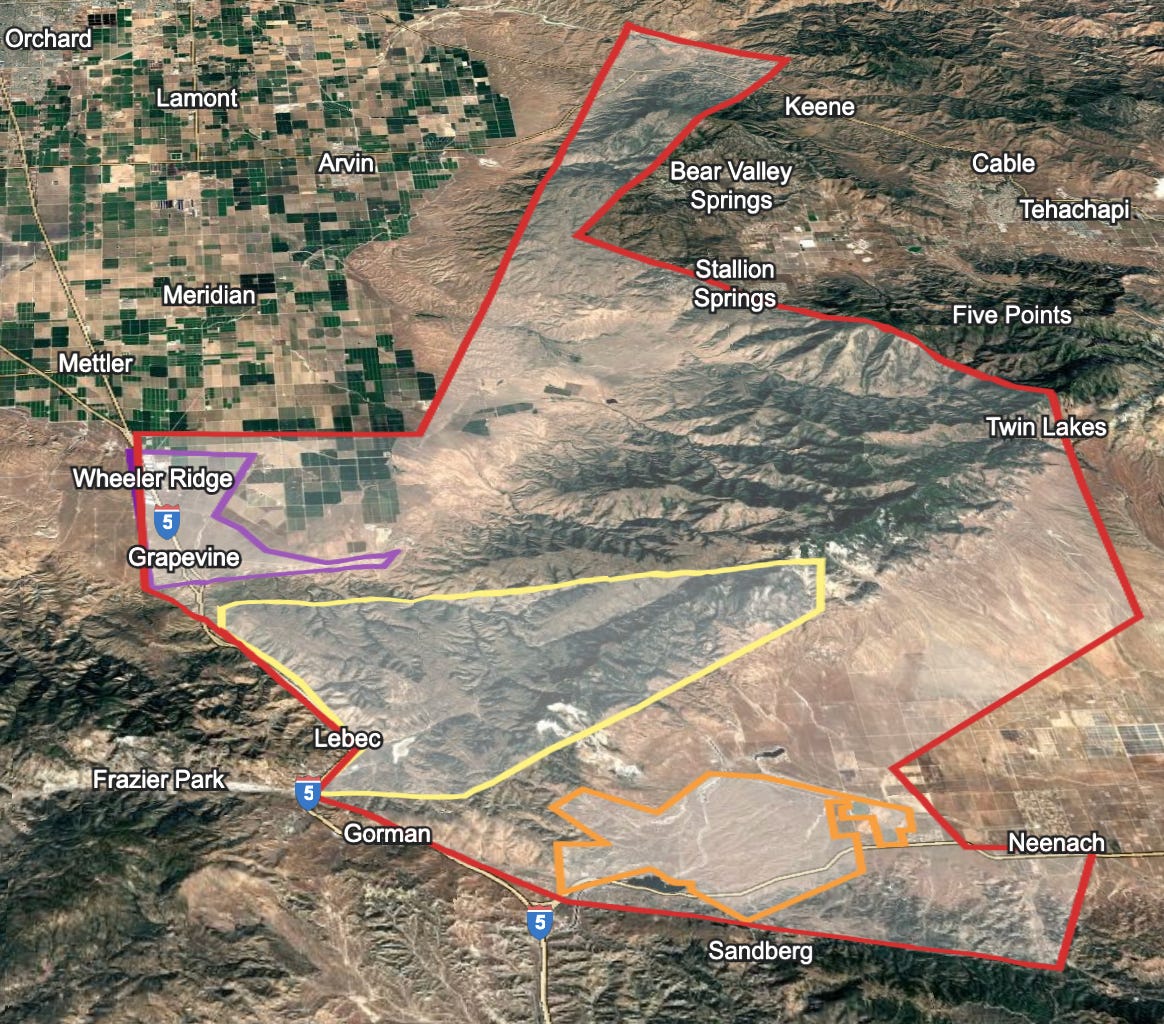

Tejon Ranch Co. is a diversified real estate development, mineral resources, and agribusiness company that owns 270,000 acres of contiguous land at the intersection of Kern and Los Angeles counties. Positioned 60 miles north of downtown Los Angeles and 15 miles east of Bakersfield, this vast property is bisected by Interstate 5 (I-5), one of the busiest freeway sections in the United States, spanning from Canada to Mexico.

Through a 2008 conservation agreement, 240,000 acres of Tejon Ranch have been set aside for long-term preservation, leaving approximately 30,000 acres available for the company’s mixed-use development goals. The company’s most active development project is the Tejon Ranch Commerce Center (TRCC), a commercial, industrial, and retail hub that benefits from heavy freeway traffic. With approximately 100,000 vehicles passing through daily, the TRCC has become a frequent stop for travelers between Northern and Southern California. In addition to the TRCC, Tejon Ranch Co. owns valuable assets including farmland, water rights, oil and gas royalties, and entitled land to build three master-planned communities, yet the company’s economic moat lies in its complete ownership and control over development.

Thus, Tejon Ranch Co. has a lucrative opportunity to increase its intrinsic value for the next several decades.

Here’s a summary of TRC’s assets today:

TRCC – encompasses 1,450 acres; the current entitlement profile is below:

TRC has multiple unconsolidated JV’s in TRCC, including Petro Travel Plaza, Rockefeller Group, and Majestic Realty, which collectively produced cash flow of around $30 million in 2023. (TRC’s share is 58%, or roughly $17 million).

Mineral Resources – water, cement, rock aggregate, oil, and gas. In 2023, this segment accounted for $5.8 million of operating income.

Farming – almonds, pistachios, wine grapes, and hay, generating $14 million in revenues but was unprofitable (2023 operating losses were $1.3 million).

Ranching – game management (hunting, filming, high desert hunt club) and grazing, posting $4.5 million in revenues and a $536 million operating loss.

Master-planned communities — In addition, TRC is entitled to develop three master-planned communities.

“We believe investors that focus on the liquidation value of St. Joe’s land suffer from ‘first-level thinking.’ St. Joe has no intention of ‘liquidating’ its land holdings so whether the land is presently worth $2,000 per acre, $5,000 per acre or $50,000 per acre is not pertinent to the underlying investment opportunity.” - David Spier

Mr. Spier's quote above regarding St. Joe applies to TRC today. The market currently believes the business is worth $433 million; roughly $15,000/acre valuation on its entitled land. At this price, an investor receives an undeveloped land company with strong cash flows, inflation-resistant assets, and a healthy balance sheet. However, the acronym “NAV” better stands for “Not-Actual-Value” when lackadaisical management is at the helm; a perennial value trap.

Nonetheless, the future has looked increasingly bright as multiple investment funds have expressed their disdain for TRC’s horrendous capital allocation, compensation practices, and lack of engagement. Nitor Capital Management and Glenbrook Capital Management both issued letters to Tejon Ranch Co.; the former addressing shareholders to withhold their support for the election of “Compensation Committee Chair Steven A. Betts, Chairman of the Board Norman J. Metcalfe, Real Estate Committee Chair Geoffrey L. Stack and Nominating Committee Chair Michael H. Winer, and voting AGAINST approval of executive compensation” (Nitor Capital Management LLC.); the latter asking for more transparency, and communicated their skepticism regarding TRC’s adherence to NCM’s direction (rightfully so, Glenbrook has held shares for 50 years and has not made money). Fortunately, Mr. Spier’s cogency toward shareholders resulted in an exponential increase in the percentage of votes withheld from the selected nominees.

https://scr.zacks.com/news/news-details/2024/TRC-Believe-Shareholder-Vote-has-Positive-Implications-for-Company-Direction-New-CEO-Search-/default.aspx

TRC is at a critical juncture as CEO Gregory Bielli is retiring at year-end; the search for a qualified executive has been on since March of this year. The question remains: will directors act in their best interests or the shareholders? This a somewhat rhetorical question, because Mr. Bielli still holds a board seat (Bielli has collected $30 million over the past decade at the expense of shareholders). The odds are that his successor resembles such covetous tendencies. Nevertheless, if the board can swallow their pride, listen to shareholders, take a pay cut, and turn over the keys to an able manager, then all is fine.

Comments from X users in agreement with NCM’s initial letter to shareholders (source: X) –

@petervon33: “I am a long time investor in TRC also. Recently, I tried contact investor relations asking similar questions about return of capital, transparency, etc. and there was no response. Thank you for your letter!”

@californiacpa21: “All senior management should be fired. Many have been there for 20 plus years while the stock is where it was in the mid 80’ss. Senior management has been massively overpaid for their horrible performance”.

@JaFoFinance: “$TRC management & board has been with this company for so long and the stock price has dwindled for decades.

CEO: 11 years

COO: 30+ years

EVP Real Estate: 23 years

Chairman (Executive): 26 years

Director (Real Estate Chairman): 26 years

Director (Corp Governance): 23 years”

In the following month since his initial letter, Mr. Spier wrote two more letters, commending shareholders for their votes and further cementing his stance against the board, “However, should the Board fail to adequately address the message sent by stockholders at the Annual Meeting, we are committed to holding the Board accountable and will not hesitate to take any actions that we believe are necessary to ensure that stockholder interests are prioritized in the boardroom.” (Nitor Capital Management LLC)

Business “surgery”:

This particular situation rhymes with Bruce Berkowitz’s (Fairholme Capital) St. Joe (JOE) investment and is akin to Buffett’s “excisable cancer” analogy.

Buffett introduced the idea in his 1980 letter to shareholders:

"GEICO's problems at that time put it in a position analogous to that of American Express in 1964 following the salad oil scandal. Both were one-of-a-kind companies, temporarily reeling from the effects of a fiscal blow that did not destroy their exceptional underlying economics. The GEICO and American Express situations, extraordinary business franchises with a localized excisable cancer (needing, to be sure, a skilled surgeon), should be distinguished from the true "turnaround" situation in which the managers expect - and need - to pull off a corporate Pygmalion."

Mr. Berkowitz realized the irreplaceable assets St. Joe owned, 120,000 acres of contiguous land near the beautiful beaches of Florida and a fully developed coastline alongside the 98 highway. The company was run inefficiently and Berkowitz launched a campaign, gaining control of the company in 2011. Subsequently, he sold off non-core assets, reduced overhead, bought back a little over a third of the company at an attractive price, and built an amazing city over the last 13 years. The cancer “surgery” was a success, and today the company is valued at $3.4 billion (market capitalization was $800 million at year-end 2018) and still has a long runway ahead of itself. Mr. Spier, another investor aware of St. Joe’s underlying value, wrote extensively about the company and made it a core position for NCM in 2017. (refutation of Kerrisdale's short thesis).

Tejon Ranch Co. is a completely different business than Geico and American Express, but shares a common denominator in its satisfactory economics and suffering from parasitical management. NCM would not have bought 1.8% of the business if the business fundamentals were deteriorating. In 2023, the company produced revenues of around $100 million and cash flows of $30 million, without selling off any land.

*(One of the best business “surgeons” around is Engaged Capital’s Glenn Welling; Later in this report, I write briefly about how having him as another strategic investor would provide enormous value).

Land companies; a well-known, and very profitable territory for NCM:

In one of his write-ups on St. Joe in 2018, “Nitor Capital Management has an over ten-year history of investing in publicly traded land companies. Since inception, our portfolio of land companies such as Texas Pacific Land Trust (TPL), Howard Hughes Corp. (HHC), and Consolidated Tomoka (CTO) has delivered a combined average annualized return of over 20%. We believe we have developed a high-level understanding of the necessary attributes required to make money in the land business. Overtime we have learned that superior returns come from those companies with minimal debt, ample liquidity, pre-existing income streams (that cover the fixed expenses of the operation) and highly concentrated land positions that provide built in barriers to entry.

Put simply, TRC is a business with a strong economic profile, and the key to unlocking a decade's worth of intrinsic value is finding the right leader; someone with a common sense approach, a long-term orientation, and an understanding of proper capital allocation.

One step back, two steps forward:

Bill Brewster: “St. Joe’s is a growing story now right? It’s been quite successful in developing, I’m going to call it a master-planned community. I think that’s an accurate description.”

Bruce Berkowitz: - “Yes, but before to get to that growth you first have to stop past behaviors and practices. Yet many times in life you have to take a couple of steps back in order to take a lot of steps forward. It’s a painful process. The optics aren’t good; no one wants to see you going backwards, so it took time”

Mr. Spier has advocated the reckless approach TRC management has taken by developing three MPCs simultaneously be redirected, “While we can appreciate that aggressively pursuing all three MPC opportunities may have been a sound business strategy at a certain point in the Company’s history, the success of the Company and stockholder returns are no longer fully dependent on the eventual development of the MPCs. At this point, we believe it makes sense to aggressively pursue only the Grapevine MPC, which is already fully approved and adjacent to the Tejon Ranch Commerce Center, which we are confident will add substantial future value for stockholders.”

Spier’s approach reminds me of a quote from Buffett, "You can't produce a baby in one month by getting nine women pregnant". The development of a city is similar to pregnancy; it’s an arduous process that can’t be rushed but brings delight to all parties in the end.

Lay of the land: Red – Tejon Ranch, Purple – Grapevine, Yellow – Mountain Village, Orange – Centennial

Grapevine (8,010 acres):

“We believe a tremendous amount of value has come from the Commerce Center development (TRCC). According to $TRC's filings, less than $25 million of Tejon's own capital has gone into the development of this asset (majority of development has been funded by municipal reimbursements and JV equity). We believe the Commerce Center is now generating over $20 million of recurring annual cash flows and has remaining undeveloped land worth over $200 million. Furthermore, the continued development of TRCC is what increases the future value of Grapevine project every year.” (X) - David Spier

Grapevine is Tejon Ranch Co.’s most northern community, located at the base of the foothills in the San Joaquin Valley portion of the ranch, and is entitled to housing 12,000 units and 5.1 million square feet of commercial/industrial space. This area is close in proximity to the Tejon Ranch Commerce Center (TRCC), which is home to several distribution centers inhabited by companies like Nestle, Caterpillar, and Dollar General. Additionally, the commerce center has Tesla’s original supercharging station, and it’s one of the country’s largest.

(Terra Vista rendering, 495-unit apartment building):

“It’s the development of a town, sort of reminds me a little bit, remember the game Sim City, you had a blank canvas and you have to lay in all the infrastructure.” - Bruce Berkowitz

TRC is still on level one in its game of “SimCity”, and it will take 20+ years for the game to be considered to be “finished”. TRCC will help fund the development of Grapevine, which will enhance cash flows to invest in the growth of Mountain Village and Centennial.

TRCC:

“The Los Angeles industrial market is the largest in the country by most measures, sitting at the center of a 2 billion square-foot Southern California industrial market. It has been characterized by some of the highest asking rents and lowest vacancy rates of any market in the nation. The Ports of Los Angeles and Long Beach are the primary industrial drivers and are responsible for over 40% of all inbound containers into the U.S.” (Tejon Ranch Co.)

TRCC has 8.2 million square feet of operational or soon-to-be-built space, with 2.8 million square feet owned through joint ventures with Majestic Realty Co. (MRC) and 5.4 million owned by others. Additionally, 11.1 million square feet of entitled industrial space is ready for future development, offering flexibility for lease, speculative projects, or build-to-suit options.

Also, TRCC has started building apartments with the construction of “Terra Vista”, which began in January 2024 and will bring 228 units online by Spring 2025. At completion, Terra Vista will comprise 495 units located adjacent to the Outlets, driving more commercial demand to the area which will create a virtuous cycle of real estate development.

In 2023, TRCC:

– Secured a pre-construction lease with Sunrise Brands for a 446,000-square-foot facility, completed in December (JV with Majestic Realty).

– Finalized a lease with RectorSeal, part of CSW Industrials, which will occupy half of a 480,000-square-foot facility. (JV with Majestic Realty).

– Nestle USA started building a 700,000-square-foot automated distribution center at TRCC, set to open by 2026, further underscoring the region’s appeal as a logistics hub for the West Coast. (Sold land to Nestle).

Three weeks ago, TRC announced it “signed a joint venture agreement with Dedeaux Properties to develop and lease an approximately 510,500-square-foot, state-of-the-art industrial warehouse at the Tejon Ranch Commerce Center (TRCC)” (Tejon Ranch Co.), and now TRCC has about 10.6 million sq. ft. of entitled industrial land left.

TRC has great partners. Majestic Realty Co. was founded in 1948 and is family-owned, led by Edward P. Roski Jr. (who succeeded his father), and is the largest privately-held developer of master-planned business parks in the U.S. With a 90-million square-foot portfolio spanning industrial, retail, and hospitality projects. Their long-term approach aligns well with TRCC’s mission, making them a valuable partner in creating lasting value through well-executed development.

https://www.majesticrealty.com/downloads/SOQ_LO.pdf – (TRC on page 50)

“Our business model of maintaining ownership of all our properties creates a vested interest for us that each one is a long term success and it also requires that we help build sustainable communities. Likewise we build long term relationships with our tenants and financial partners, helping our tenants address their real estate needs as their businesses expand across the nation.” - Edward P. Roski Jr.

https://www.majesticrealty.com/projects/tejon-ranch-commerce-center/

Mountain Village and Centennial:

Per Mr. Spier’s recommendations, it would be wise for TRC to focus on developing Grapevine, establishing durable cash flows that could be then used to subsidize the MV and Centennial communities.

Mountain Village is fully entitled to 3,450 homes, 750 hotel rooms, and 160,000 square feet of commercial space. The company is targeting higher-end vacation homes, which could align nicely with the hunting season.

https://www.reddit.com/r/Hunting/comments/ac7o0h/joe_rogan_75_yd_archery_elk_harvest/

http://hunt.tejonranch.com/gallery/photos/#prettyPhoto

Centennial is planned for 19,333 residential units and 10.1 million square feet of commercial/ industrial/ space. TRC owns 93.57% of the Centennial Founders joint venture with TRI Pointe Homes to pursue the entitlement and development of land. TPI Pointe Homes (TPH) is led by founder and CEO Doug Bauer, who has an impressive track record in the homebuilding industry and has driven the company to tremendous success. Their average selling price per home is $693,000.

Petro Travel Plaza:

Petro Travel Plaza Holdings LLC – An unconsolidated joint venture with TravelCenters of America Inc. for developing and managing travel plazas (truck stops) and convenience stores. The Company has 50% voting rights and shares 60% of profit and losses in this joint venture. It houses multiple commercial eating establishments, as well as diesel and gasoline operations in TRCC, and produces the bulk TRCC’s earnings.

Hard Rock Hotel & Casino (TRC doesn’t have any ownership):

Another source of demand for Tejon Ranch Co., located at the intersection of Highway 99 and State Route 166. The project will create 5,000 jobs and is set to finish by December 2025. In an interview with the Kern Economic Development Corp, Octavio Escobedo III, chairman of the Tejon Indian Tribe, stated “Tourism in Kern County is about a $2 billion industry, [with] almost 20,000 employed,”... “And the wonderful thing about [the Tejon tribe’s] project is, [it’s] new money. Estimates are that 90 percent-plus of the folks coming in are from out of the county. [They’re] coming in, spending money, staying several days.”

Project rendering: https://casino.hardrock.com/tejon/project-vision

Valuation:

As mentioned earlier in the write-up, buying TRC at a steep discount to net asset value is not indicative of satisfactory investment returns, but it does provide an adequate margin of safety. The company has a net cash position, recurring revenues, constructive activism from intelligent investors, and an unscrupulous board on the cusp of a departure; and business momentum paired with TRC’s future developments offer the investor a minimal chance of a permanent capital loss.

“Tejon Ranch owns a portfolio of highly valuable and sought after income producing assets (as well as 11 million sq. ft. of fully approved industrial development rights). These assets are generating over $100 million of recurring annual revenues and $30 million of annual cash flows. As a result, we believe Tejon Ranch has reached a point where these assets are now worth $700 million, or $26 per share of value, not including the Company’s 270,000 surface acres. When adding the book value of the Company’s remaining 270,000 acres and the value of the Company’s water and farmland, we believe the total value of Tejon Ranch’s assets, net of all debt, presently exceeds $44 per share (or $1.2 billion), on a conservative basis. This represents nearly three times the value of the Company’s current stock price”.- David Spier

In 2022, TRCC sold a 27.88 acre industrial land parcel to Majestic Realty for $8.5 million ($305,000/ac.)

11 million sq. ft = 252.5 acres 252.5 x 305,000 = 77 million

If one values TRCC’s entitled land for industrial development at $77 million (~305,000/ac), then we must capitalize the commerce center’s $30 million of cash flow at 21x to arrive at Mr. Spier’s $700 million valuation; a reasonable multiple given their prospective growth. Spier values the rest of TRC’s assets at $500 million, which include: a water bank and mineral resources (collectively producing around $6 million of income); farming and ranch operations which have been modestly unprofitable, and 270,000 acres (master-planned residential developments approved totaling 35,278 housing units, and about 27 million square feet of commercial entitlements available).

Currently, the market capitalization of TRC is $433 million.

“You don’t have to know a man’s exact weight to know that he’s fat.” – Benjamin Graham

It is evident shares of Tejon Ranch Co. offer an attractive investment proposition; the company’s strong balance sheet coupled with TRCC’s cash flows provide a solid margin of safety. However, it’s difficult to estimate a range of future cash flows for the company’s development projects if the current management and board continue to operate the business. The crux of this investment leans on TRC’s shareholders to replace current executives with competent leadership.

“The big question is when these assets will be developed and monetized and therefore when the stock market will give credit for the intrinsic underlying value. We have seen the shares of other land companies explode on news of development and monetization (TPL and St. Joe Co. for example). We are, of course, patient long-term investors and are fully aware that the value of TRC may take decades to out itself. We are also aware of other likeminded buyers interested in spurring action so as to see results sooner rather than later. We would love to find a strategic investor(s) to join us so we ask that you please feel free to contact us if interested. We have a deck prepared by our colleague, David Spier, outlining why the company is worth multiples more than it’s selling for, which we would be happy to share.” - Lawrence Goldstein (Santa Monica Partners, or SMP Asset Management)

Mr. Goldstein is a legendary investor with a track record of buying small and obscure stocks, generating gross mid-teens returns since the early 80s. Now, he’s pursuing congenial investors to join him and Mr. Spier in driving corporate change, and ultimately the development of TRC.

Engaged Capital

Glenn Welling, founder and CIO of Engaged Capital, a constructive activist fund targeting small and mid-cap companies located in Newport Beach, CA, would be invaluable as a strategic investor in TRC. Mr. Welling has decades of experience in the field of activism, working with Ralph Whitworth at Relational Investors before starting his firm in 2012. Currently, Engaged Capital’s top positions include BRC, or Black Rifle Coffee (BRCC), Evolent Health (EVH), NCR Voyix Corporation (NCR), VF Corp (VFC), and NCR Atleos Corporation (NATL); these holdings account for 65% of the portfolio.

Throughout this year, Engaged Capital has been exiting its position in Shake Shack (SHAK), recording a significant profit. Mr. Welling worked with Shake Shack’s Chairman Danny Meyer by starting with the board, adding two directors with QSR experience, a former Dominoes CFO, and a former COO of Panera and Dairy Queen. Subsequently, the stock re-rated, doubling since the fund’s initial position in Q1 2023.

“I can’t fix a bad business, but I can fix a bad valuation of a good business” - Glenn Welling

While Engaged Capital does not own any land companies, and predominantly invests in iconic consumer franchises, they are long-term investors targeting businesses with superior economics overshadowed by mediocre governance. The fund’s strategy is outlined on its website, and TRC meets the requirements.

The investment by Engaged Capital alongside NCM and SMP in Tejon Ranch Co. would mark a pivotal moment in the company’s history. These prominent investors will attract the right leadership, providing the impetus needed for TRC’s stock to reach its true value. Still, TRC’s directors have a multi-decade presence and might be glued to their seats. The proliferation in withheld votes by shareholders highlights the awareness Mr. Spier has raised toward management’s wrongful actions. The board should step down, but if they remain stubborn, a proxy fight would need to ensue, and Mr. Welling is an exemplar of successful boardroom battles.

Lastly, Maui Land & Pineapple Company (MLP) provides a recent example illustrating the profound impact a new corporate regime can have on a dormant land company and its stock price. In 1999, Steve Case (then CEO of AOL) acquired a 41% stake in MLP, joined the board, and made the purchase as a long-term investment. He added to his position over time, but the company had meager cash flows and made mediocre investments. Case demonstrated remarkable patience, and in 2022 reincorporated the company from Hawaii to Delaware, one reason being to attract qualified leadership. In March 2023, the

business added a new CEO, Race Randle, and Chairman Scott Sellers, both well-regarded in the real estate development industry. Since then, the stock has roughly doubled.

Hopefully, the Tejon Ranch Co. will enjoy a similar fate.

well written!