Rayonier (RYN) is a timberland REIT selling at a wide discount to an appreciating net asset value, and they recently authorized a share repurchase program.

Rayonier originated as the Rainier Pulp & Paper Company, founded in Shelton, Washington, in 1926. On June 27, 2014, Rayonier completed the tax-free spin-off of its performance fibers manufacturing business – Rayonier Advanced Materials (RYAM) – from its timberland and real estate operations, becoming a “pure-play” timberland REIT, producing cash flow mainly from the harvest and sale of timber.

RYN’s timberland portfolio includes assets across the U.S. South (1.75 million acres) and the U.S. Pacific Northwest (308,000 acres). Last month, RYN sold its 77% New Zealand joint venture stake for $710 million, implying a total purchase price of $922 million, or $3,212.54 per acre.

RYN’s selling of its New Zealand timberland was part of the company’s greater plan, set in the fall of 2023: sell $1 billion worth of assets, lower debt levels, and increase capital returns. Closing the New Zealand deal would result in $1.45 billion of cumulative disposition proceeds.

Despite having good business momentum, Rayonier’s stock has nearly been cut in half. Management doesn’t agree with the market, though. Several months ago, RYN announced a $300 million stock buyback program – 7.9% of the current market cap.

Here’s a quick, back-of-the-envelope NAV calculation (per acre values are based on investor presentations and recent disposals).

U.S. South: 1.75 million acres x $2,475 = $4.33 billion

U.S Pacific NW: 308,000 acres x $3,500 = $1.08 billion

Net debt: $132.7 million (post-disposition of NZ stake)

Net asset value = $5.27 billion

Market cap = $3.80 billion

NAV per share = $33.77

RYN share price = $24.38

Discount to NAV = 27.8% (38.5% upside)

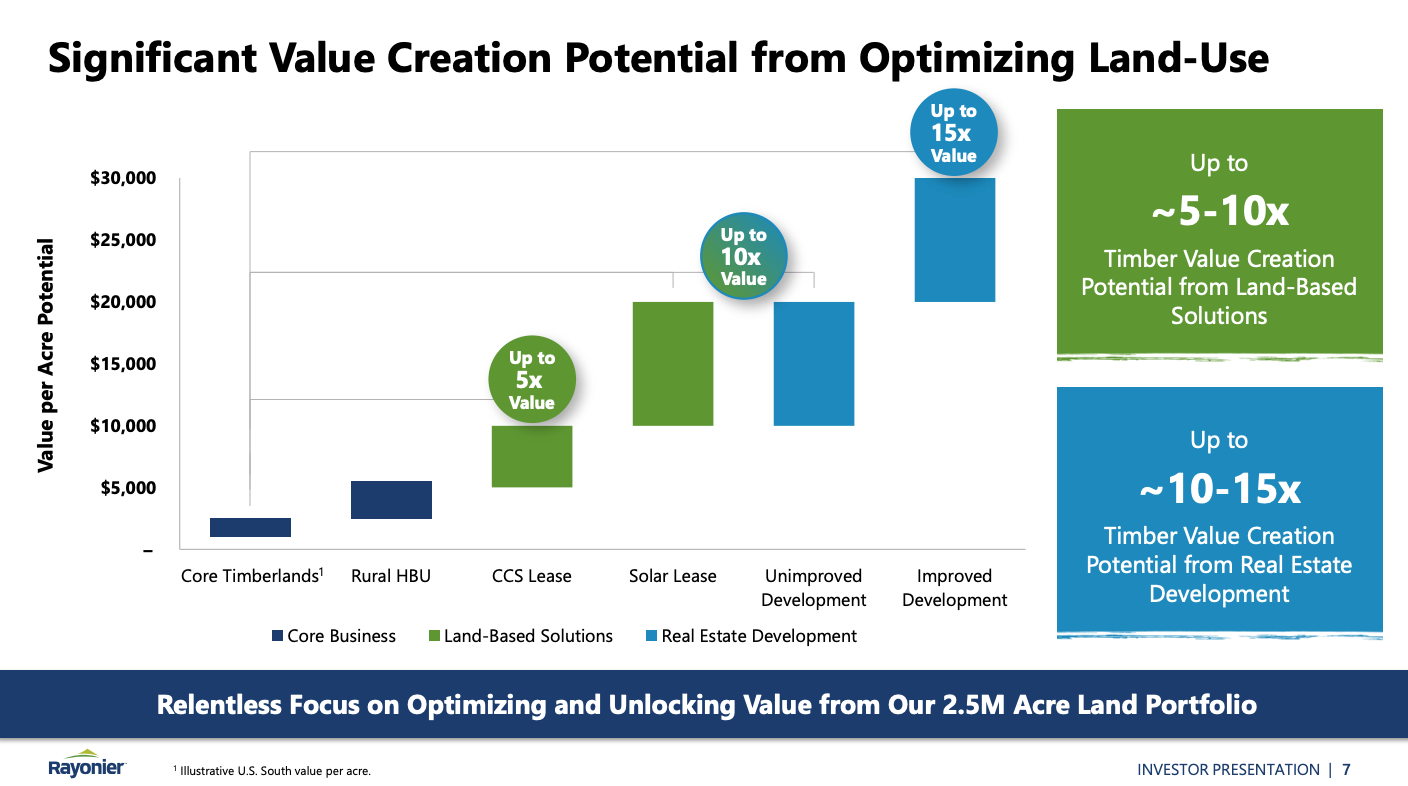

RYN has a sustainable yield (the average harvest level that can be sustained into perpetuity) of approximately 7.5 million tons and produced about $230 million of cash flow from timber last year, including NZ. Still, they’re evolving into a land resources company. RYN is focused on increasing the company’s intrinsic value over time from land improvements, such as solar, carbon capture and storage (CCS), real estate development, and other higher-and-better use (HBU) opportunities.

Excerpts from Rayonier CEO Mark McHugh regarding land values: “Only a small portion of our lands will ultimately be suitable for these alternative uses, but consider this. If we’re able to convert just 1% of our land to one of these higher-value uses that has a value uplift of 10 to 15 times, well, that implies a 10% to 15% value lift in the company. Now, imagine if we’re able to convert 5% or even 10% of our lands to these alternative uses over time. It has a potential to really transform the value of this company.”

According to RYN’s recent investor presentation, from 2000 to 2024, timberland values grew at 2-3%. If land improvements materialize, RYN’s acreage values should grow at a much faster clip.

Rural HBU: “Over the past decade, we’ve seen a significant uptick in both our average HBU sales price per acre (2015-17: $2,763 → 2021-24: $4,468) and the implied premium above the NCREIF South average timberland value per acre (2015-17: 55% → 2021-24: 117%). Our ability to continuously realize significant premiums above timberland values on our HBU land sales contributes meaningfully to the overall return profile of our land portfolio and represents a significant competitive advantage for Rayonier.” Rural HBU land is primarily sold to high-net-worth individuals, both for investment purposes and recreational use.

Solar: “U.S. utility solar developers are projected to add ~30-35 GW of electricity generating capacity annually through 2030, which implies an annual land need of ~200,000-250,000 acres (based on ~7 acres of land per MW of generating capacity). With many of these capacity additions expected to take place in the U.S. South, we believe this presents a significant opportunity for large landowners like Rayonier. We finished 2024 with ~39,000 acres under option for solar development, up from ~27,000 acres at year-end 2023.”

Carbon capture & storage: “In December 2024, we announced a new pore space easement agreement with an affiliate of Reliant Carbon Capture and Storage covering ~104,000 acres in Alabama. As a result, we had ~154,000 acres under CCS lease as of year-end 2024, up from ~26,000 acres at year-end 2023, and our team continues to advance discussions with several high-quality counterparties regarding additional CCS lease opportunities. Fortunately, significant portions of our land base are well positioned to offer an attractive combination of: (1) geological storage capacity, (2) proximity to high-purity emissions sources, and (3) access to pipeline infrastructure—the three key ingredients for cost-effective CCS development.” ExxonMobil has signed underground pore lease agreements with Rayonier, covering approximately 59,000 acres.

Real estate development: “Notably, both our Wildlight project north of Jacksonville, FL and our Heartwood project south of Savannah, GA each surpassed $100 million of project-to-date revenues in 2024. While this is a significant milestone for each of these projects, what’s even more exciting is the lengthy runway we see for future growth. We own ~17,000 entitled acres within our Wildlight project and ~9,700 entitled acres within our Heartwood project. Collectively, these land-use entitlements provide for ~37,000 residential dwelling units and ~44 million square feet of commercial uses. Thus, while we’re encouraged by the progress to date on both projects, we’re even more optimistic about the long-term value creation potential that can be achieved as these projects continue to mature and catalyze demand for our adjacent landholdings.”

Summary: RYN offers a good margin of safety. An inflation-resistant asset for cheap, with solid growth prospects. Further, management has de-levered the balance sheet, and shareholders will soon be rewarded with buybacks.

CEO Mark McHugh’s presentation at Rayonier’s 2024 Investor Day: Embarking on a New Era of Growth

Investor Conference Presentation, March 2025: https://ir.rayonier.com/static-files/a7710e62-4bfe-429b-a5b1-fd7b7196cec3