Saylor sold his soul for USD. So please, don’t sell your kidney, or anything else, for BTC.

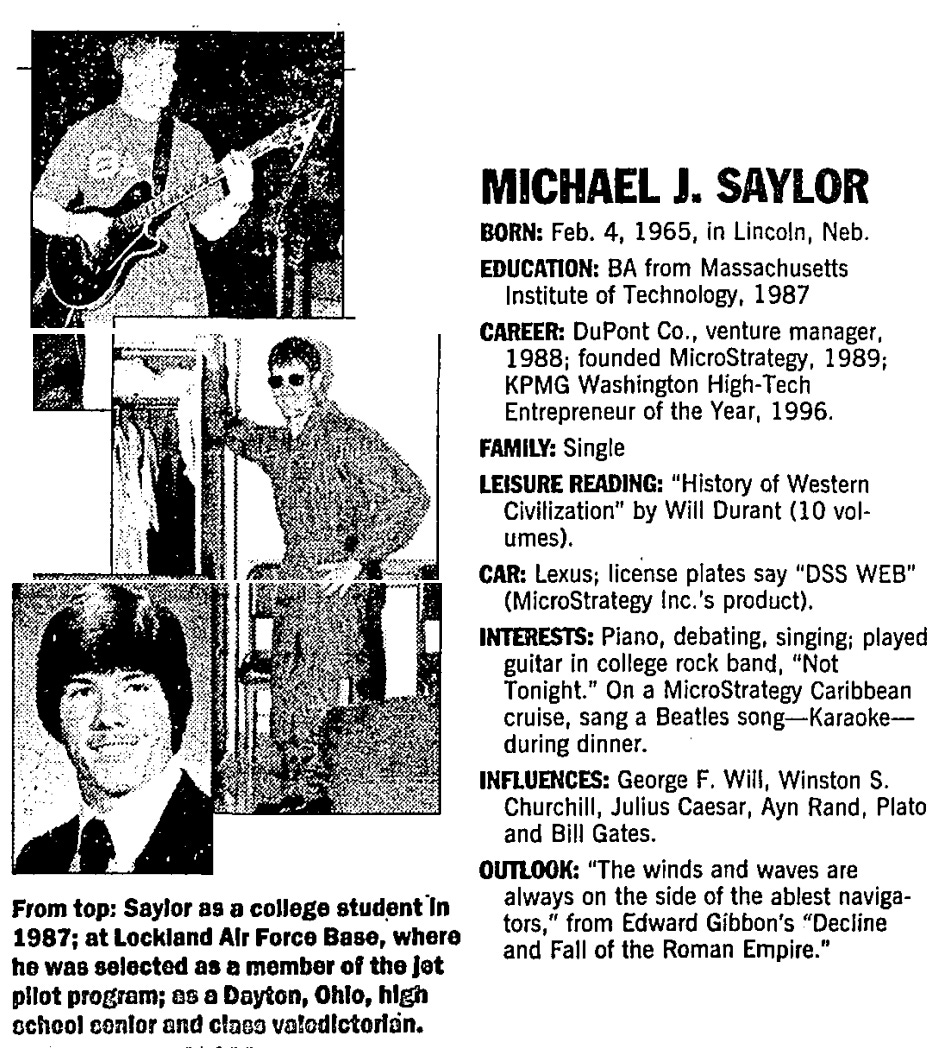

MicroStrategy, before the crypto boom, was purely a software company. In 1998, the business went public. Michael Saylor was young (31), rich, and euphoric. MSTR neighbored MSFT (Microsoft) on the ticker tape, and the wiz-kid from MIT's net worth ballooned to $540 million. On IPO day, Saylor left Merrill Lynch’s trading floor reluctantly. Watching his wealth surge, tick by tick, was heroin. Going up the elevator, Saylor claimed that “MSTR” stood for master, as in “of the universe”. Everyone laughed – but it wasn’t a joke.

Nearly three decades later, Saylor, once again, is an innovative genius. He’s flirting with the Forbes 400 list (placed at #401) with a net worth valued at over $7 billion, and “MSTR” has a $75 billion – with a B – market capitalization.

Michael Saylor’s heroes are Caesar, Gates, and Gandhi. He’ll be remembered, however, for being more like Madoff, Belfort, and Jones (as in cult leader Jim Jones, responsible for the mass suicide in Jonestown). You might disagree that Saylor is a sheisty, crooked con man. Accounting fraud and tax evasion are only a pastime.

But a lethal cult leader? Saylor did advise his followers to “sell a kidney” to hodl their bitcoin, but he hasn’t forced anyone to drink cyanide. While nonviolent, Saylor is undoubtedly a malignant cult leader. By understanding basic human psychology, Saylor captured the minds of millions and financially exploited them. An excerpt from one of Charlie Munger’s favorite books tells us how.

“Influence: The Psychology of Persuasion” by Dr. Robert Cialdini. Page 156.

“From my own perspective, most attempts to analyze the Jones-town incident have focused too much on the personal qualities of Jim Jones. Although he was without a question a man of rare dynamics, the power he wielded strikes me as coming less from his remarkable personal style than from his understanding of fundamental psychological principles. His real genius as a leader was his realization of the limitations of individual leadership. No leader can hope to persuade, regularly and single-handedly, all the members of the group. A forceful leader can reasonably expect, however, to persuade some sizable proportion of group members. Then the raw information that a substantial number of group members has been convinced can, by itself, convince the rest. Thus the most influential leaders are those who know how to arrange group conditions to allow the principle of social proof to work maximally in their favor”.

A master of the universe must first have his or her army of minions. Search “$MSTR” on X, and you’ll find Saylor’s. Laser beams for eyes glow up their profiles; “believer” and “maxi”, short for a maximalist, are tattooed in their bios. Constant posting, with a domineering vernacular, is a rite of passage. Their endgame is to “orange pill” investors, a dysphemism for purchasing bitcoin.

Surprisingly, Bill Miller, a legendary “value” investor, is a bitcoiner, too. And his son, Bill Miller IV. As it happens, many have followed their lead. It's hard to argue against such astute capital allocators.

Bill Miller IV’s header on X is a cheetah, posted up in a tree, licking its chops. His profile picture is a self-portrait of himself with red, fulgent bursts of light for eyeballs. His bio reads “logician. investor. #bitcoin.”

Miller is gravely mistaken, though. He’s not an investor. Heeding Benjamin Graham’s words of wisdom, crypto buyers are unintelligent speculators.

“There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are: (1) speculating when you think you are investing; (2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and (3) risking more money in speculation than you can afford to lose.” ― Benjamin Graham, The Intelligent Investor

Miller certainly falls victim to Graham’s first point. Here are a couple of Bill Miller IV’s posts on X (@billfour):

“I believe failing to own any #bitcoin will continue to be the biggest investment #mistake of the 21st century”.

“Every generation has its story asset -- the thing that you never sell and it just keeps going up. For my grandparents, it was $GE. For my parents, it was $AMZN. For me, it's BTC. #bitcoin”.

Bill Miller III bought shares of Amazon in 1999. It was led by founder and CEO Jeff Bezos and had increasing market share, revenues, employees, etc. In 2001, the stock capitulated with the rest of the dot.com crew, but the business didn’t. Bezos made that clear in the annual letter to shareholders:

“So, if the company is better positioned today than it was a year ago, why is the stock price so much lower than it was a year ago? As the famed investor Benjamin Graham said, ‘‘In the short term, the stock market is a voting machine; in the long term, it’s a weighing machine.’’Clearly there was a lot of voting going on in the boom year of ’99—and much less weighing. We’re a company that wants to be weighed, and over time, we will be—over the long term, all companies are. In the meantime, we have our heads down working to build a heavier and heavier company.”

It’s a vote-heavy market today, and MSTR has been elected a $76 billion valuation. That’s a market capitalization greater than Colgate Palmolive ($74 billion), General Dynamics ($72 billion), and Canada Pacific Kansas City ($67 billion), all financially fat businesses tipping the scale.

Now, pretend for a moment that the voting polls are closed. Imagine that MicroStrategy is about to hop on a scale with all of its precious bitcoins (506,137 to date). What would it weigh? Nothing. Bitcoin doesn’t produce anything. It’s rat poison, pixie dust, another mechanism for gambling. Criminals like it too; ask Dread Pirate Roberts.

So, if you hold any cryptocurrency: bitcoin, solana, $TRUMP, or fartcoin, do yourself a favor, and sell it. Crypto isn’t digital gold; it’s digital cocaine. If your financial advisor convinced you to put some of your assets into cryptocurrency, get a new one. The road to hell is paved with good intentions. What started as a “hedge” against inflation morphed into a speculative orgy.

Attached are screenshots of articles from Saylor’s first rodeo during the dot-com bubble, along with other crypto propaganda. If you’re tempted to buy crypto, refer to the Buffett content below.

Warren Buffett on bitcoin and crypto: We've had an explosion of gambling

Buffett: I wouldn’t pay $25 for all the bitcoin in the world

Nice one. Check this out - https://microcapclub.com/judas-goats/

I feel Michael Saylor is the Judas goat for the Crypto maxis

A couple of years ago I went to a book group where the author of a book about Jonestown presented her book to us. Someone asked her why she joined a cult. No one ever joins a cult, she said.