Hudson Pacific Properties (HPP) - Short

An over-levered office REIT with the bulk of its portfolio in the San Francisco Bay Area, faces multiple headwinds and is led by a suspect management team.

Price: $4.74

Fully Diluted Shares Outstanding: 141M

Market Cap: $643M

Enterprise Value: $5.9B

Hudson Pacific Properties, an over-levered office REIT ($643 million market cap) with the bulk of its portfolio in the San Francisco Bay Area, faces multiple headwinds and is led by a suspect management team. The stock price has collapsed since early 2022 from ~$25 to $4.74 today, but still has significant downside given its current valuation (6.2% implied cap rate, 4.2% dividend yield, $390/PSF).

Overview:

Enterprise Value: $5.8B

Investment in Real Estate, net: $6.6B

In-service properties: 51

Office: 13,853,005 sq ft (46 properties)

Studio: 1,231,278 sq ft (5 properties)

Development: 3,233,589 sq ft

Office Leased/Occupancy: 80.0%/78.7%

Office weighted average lease term (in months): 107.8 (this surged from the 21-year term lease with the city of SF at 1455 market; WALT last year was 48.1)

Studio Leased: 76.1%

Annualized Base Rent (ABR): $610 million

Annualized FFO (ex-SBC) run-rate: $0.48

Annualized Dividend: $0.20

Net Debt/EBITDA: 14.6x

Short Interest: ~16%

Annualized borrow rate: 0.34%

HPP’s portfolio consists mainly of class A office space with credit technology tenants located in the Silicon Valley (40% of NOI) and the San Francisco Bay Area (21.2%). Los Angeles (19.4%), Seattle (16.2%), and Vancouver (3.2%) round out the rest. Most of their assets possess prime locations and beautiful aesthetics. However, few people are in them.

Los Angeles

Properties: 9 – Square feet: 1,986,138 – Occupancy: 95.1%

San Francisco Bay Area

Properties: 25 – Square feet: 8,163,713 – Occupancy: 71.7%

Seattle

Properties: 9 – Square feet: 2,182,070 – Occupancy: 83.9%

Vancouver

Properties: 1 – Square feet: 1,521,084 – Occupancy: 87.2%

The “tech-xodus”

"There are decades where nothing happens, and there are weeks where decades happen." — Unknown

Not long ago, the Bay Area bustled with tech companies. Innovation filled the air and office space, too. Then, a black swan event—the global pandemic—forever changed societal norms. Enter Zoom, ironically based in the Bay Area, offering remote work solutions that allowed employees to carry out tasks from their cozy dwellings. This technology, embraced by millennials and Gen Z, enabled collaboration without physical presence, and while platforms like Zoom and Microsoft Teams proved invaluable, enhancing productivity and saving lives, they killed the Bay Area office market. The San Francisco office vacancy rate in Q4 2019 was 6%, compared to today’s record high of 36%, turning it from first to worst in the nation.

The departure of tech firms from the Bay Area was kicked off in late 2022 when Mark Zuckerberg of Meta published a letter titled “The Year of Efficiency.” The innovative founder argued that leaner operations (firing employees, canceling projects, focusing on tech, etc.) would lead to better productivity and performance. Subsequently, Meta achieved record financial results, and the stock has hit all-time highs. The company’s success has rippled through the tech sector, prompting significant players like Google, Amazon, Netflix, Uber, and PayPal, all tenants of HPP, to announce substantial layoffs. Efficiency has become the norm across the entire technology sector, with no indication of layoffs slowing down. Zuckerberg recently called the “Year of Efficiency” permanent. Google, a significant contributor to HPP’s revenue (10.2%), recently spent over $1 billion to cut office space from its operations. This strategic shift is reflected in HPP's financials, as seen in the recent sale of One Westside in Los Angeles, initially intended as a flagship office for Google (12-year lease). Alongside this “tech-xodus”, HPP faces a significant challenge, with a third of their ABR set to expire in the next two years.

During their Q1 2024 earnings call, President Mark Lammas addressed concerns about managing major lease expirations. He highlighted that combining the expirations for Q4 2023 and scheduled 2024 expirations, totaling approximately 1.7 million square feet, a conservative estimate of 40% retention would translate to about 700,000 square feet. Of this, they executed leases covering 75,000 square feet and another 160,000 square feet, leaving around 840,000 square feet to be leased to maintain 80% occupancy levels. However, they could not achieve these targets; occupancy decreased, and their over-promising and under-delivering track record was further solidified. With a similar scenario for the remaining year, where they face another significant wave of expirations (744,155 sq ft, $41.4 million ABR), HPP's occupancy could drop to the mid to low 70s by the end of 2024. If not, the 2 million square feet expiring ($99 million ABR) in 2025 will get them there.

Debt:

HPP manages its finances with a total debt of $3.4 billion (85% fixed), comprising $2.4 billion unsecured and $1 billion secured. Their debt carries an average interest rate of 5% and includes an unsecured revolving credit facility with an undrawn capacity of $628 million ($272 million drawn at SOFR + 1.15% - 1.60%, due 12/26). The weighted average maturity of their debt is 3.7 years. To alleviate their 2024 debt burden, they disposed of $1 billion in assets.

In HPP's Q2 2024 net debt/Annualized Adjusted EBITDA calculation (10.3x), they included items such as unrealized losses on non-real estate investments and stock-based compensation. I think they’ll get creative with these adjusted numbers in the future to avoid breaching covenants.

Looking ahead, HPP faces significant debt obligations, with $600 million due in Q4 2025 and $953 million in H2 2026. Covenant compliance has been trending in the wrong direction as well. Unencumbered NOI to unsecured interest expense is 2.4x and must be > or equal to 2.0. Adjusted EBITDA to fixed charges is 1.7x, which must be > or equal to 1.5x. Debt to Total Assets is 44.2%, must be < or equal to 60%. They will most likely breach a covenant within the next year.

So, how will they pay these debts?

CEO Victor Coleman has emphasized a relentless focus on “leasing, leasing, and more leasing,” but recent operations paint a different picture for HPP. Struggling to fill vacancies in the Bay Area, the company has shifted gears towards a selling spree ($1 billion of assets last year). Coleman’s strategy involves offloading class B assets, aiming to divest them under more favorable terms. However, with ongoing occupancy challenges and looming debt payments, waiting for a better market environment isn't a luxury they can afford. For instance, a class A office property in San Francisco (550 California Street) was bought by a Palo Alto-based private equity commercial RE fund for just over $40 million ($120 per square foot). If HPP can’t lease their once-prized assets, they must sell at giveaway prices.

Among HPP’s troubled assets, 1455 Market is a particular headache. This downtown San Francisco property, formerly Block’s HQ (leaving behind 469,056 sq ft. of vacancy), spans over 1 million square feet, with significant vacancy (60.2% occupied). Uber’s lease is set to expire in February 2025 (325,445 sq ft), which will not be renewed. The ride-hailing company moved its operations to Mission Bay and has been unsuccessful in subleasing its space in 1455 Market since before the pandemic. The property’s physical occupancy is almost 0%, adding to the city’s ghost town aura.

Management:

CEO Victor Coleman has been successful in acquiring high-quality office assets in sought-after markets and leasing them to credit tenants in the thriving tech industry. The company enjoyed a decade of solid performance before being blindsided by the global pandemic, elevated interest rates, and downturn in the tech sector – factors largely beyond their control. However, one aspect firmly within their control is capital allocation, which has unfortunately been mismanaged. In 2022, Coleman made the ill-advised decision to repurchase $255 million worth of stock at an average price of ~$25 per share. This move proved a misstep, mainly as vacancy rates increased in their core market and lease expirations emerged. It appears Coleman succumbed to the "institutional imperative,” mirroring the actions of other REITs without considering the specific circumstances of HPP. Despite destroying shareholder value, Coleman still collected millions in annual compensation.

Moreover, he sold $1.2 million worth of shares in May after saying at a Citi Conference in March: “I think the upside potential in the company currently today, given where we’re at, where our growth prospects are, and our future aspects around cash flow, it’s a great time to invest in Hudson.” Also, during the company’s recent earnings call, CFO Harout Deramerian could not answer a basic question regarding studio expenses increasing by 32% y/y; he remarked: “I apologize; I wasn't prepared for that specific question.” A CFO should have a general sense of why there was such a spike; this is lackadaisical.

As the company's fundamentals deteriorate rapidly, management's transparency has diminished. Their quarterly supplements, which historically spanned 63 pages, have been reduced to 33 pages since Q1 2023. Critical details have been wiped such as tenant breakdown by industry (e.g. online services are 40% of technology’s ABR), commenced office leases with non-recurring upfront abatements with square footage, lease start/end dates, rents, etc., expiring leases over the next eight quarters went from 36 detailed bullet points to a mere 9, while roughly the same amount of square footage is expiring, a simple vacancy % of sq. ft. calculation in the expiring leases summary, and the company outlook section. Management is trying to obfuscate their dire reality.

Valuation:

This short is particularly attractive due to its paralyzed upside. HPP is in survival mode. Growth is out of the equation as they continue to sell assets and fight for 80% occupancy by year-end.

On annualized run-rate Q2 2024 FFO (ex-SBC), HPP trades at 10x and a 4.2% dividend yield. The best peer comp to use is Kilroy Realty Corp (KRC), as most of their NOI stems from the Bay Area. KRC is trading at a 7.6x run-rate FFO and a 6.4% dividend yield despite having more geographic diversification, a less concentrated tenant base, higher occupancy, superior management, and a net debt/EBITDA of 6.5x.

The aforementioned valuation metrics regarding HPP are rich considering their deteriorating fundamentals, and a 4.2% dividend is ludicrous (they’ll have to cut it soon). A reasonable base case for the short is $3.25 (30% downside). At this price, HPP would yield an implied cap rate of 7.5%, a 6.7x run-rate FFO, and a 6% dividend yield. Without vacancy relief over the next 18-24 months, the company could face insolvency issues.

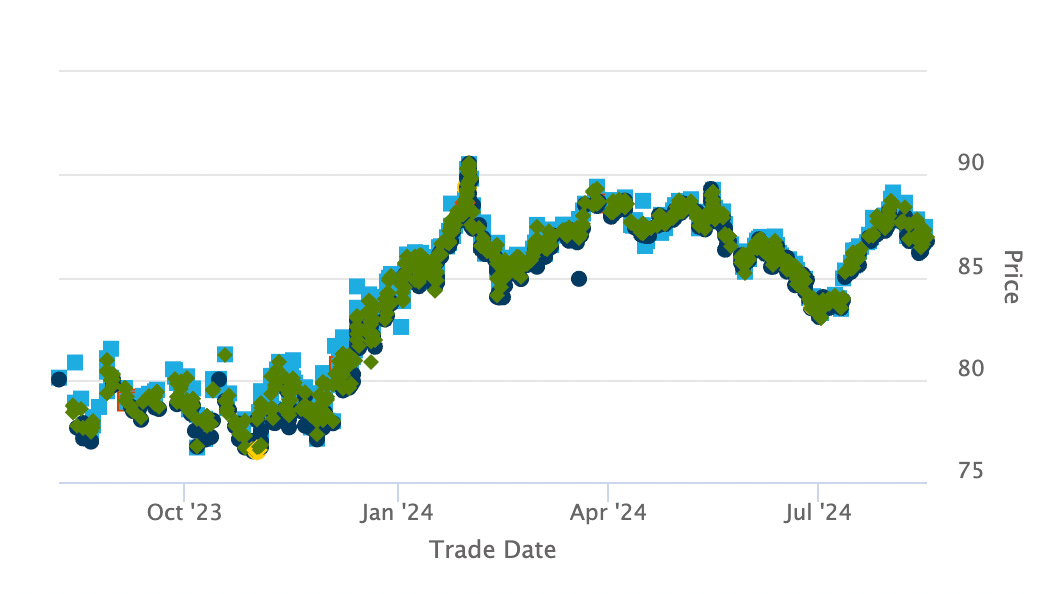

That said, their bonds (senior unsecured) are overpriced as well:

Hudson Pacific Properties 3.95% (11/2027) @ 8.340% — 87.88 BB+

Hudson Pacific Properties 5.95% (02/2028) @ 10.117% — 88.00 BB+

Hudson Pacific Properties 4.65% (04/2029) @ 9.949% — 80.750 BB+

Hudson Pacific Properties 3.25% (1/2030) @ 9.948% — 72.500 BB+

(11/2027) @ 87.88 will go down.

Thank you for the candid analysis.

Has your evaluation of the company’s prospects changed since then?

If one believed the SF class A office market were to improve, possibly due to further RTO mandates and local governments doing a better job at improving the quality of life, is there a particular publicly traded REIT that would stand to benefit?