First Citizens BancShares $FCNCA is the largest family-owned bank in the United States, and has been prudently managed for decades; they even turned a profit during the Great Financial Crisis. Their patience and conservative lending practices have allowed them to be greedy when others were fearful, which especially paid off when they acquired Silicon Valley Bank for pennies on the dollar.

For $0.5 billion in cash, FC received:

$72 billion loans (very high-quality, short-duration loans, mostly maturing in under 1 year)

$56 billion deposits

$16 billion equity

$35 billion cash from FDIC to be paid back after 5 years (at a low fixed rate of 3.5%)

A loss-sharing agreement with the FDIC to ensure the safety of the loan book (which I expect FC won't need given the high-quality nature of SVB's loans).

This deal would make any banker envious and is the reward of having excess liquidity. Although, this isn’t the first time CEO Frank Holding Jr. has been savvy, here’s a track record of his acquisitions since the GFC:

Temecula Valley Bank (2009)

Venture Bank (2009)

First Regional Bank (2010)

Sun American Bank (2010)

United Western Bank (2011)

IronStone Bank (2011)

Colorado Capital Bank (2011)

Mountain First Bank (2014)

First Citizen Bank and Trust of SC (2014)

Capital City Bank (2015)

North Milwaukee State Bank (2016)

First CornerStone Bank (2016)

Bank of Virginia (2016)

Harvest Community Bank (2017)

Guaranty Bank (2017)

Palmetto Heritage Bancshares (2018)

Biscayne Bank of Coconut Grove (2019)

First South Bancorp (2019)

Entregra Finacial Corp (2020)

Gwinnett Community Bank (2020)

CIT Group (2020)

Silicon Valley Bank (2023)

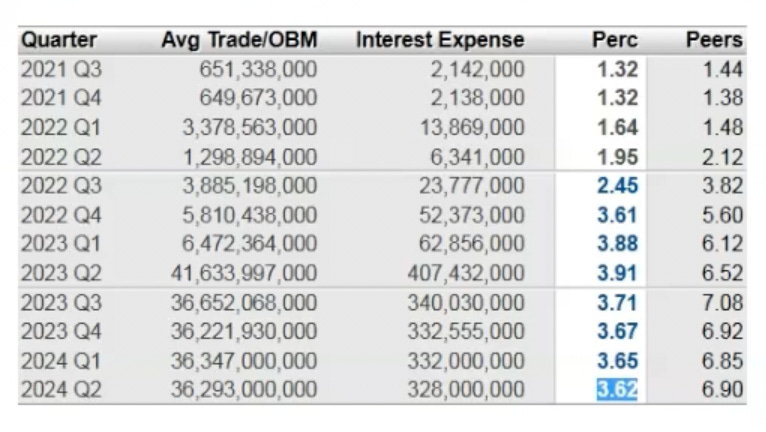

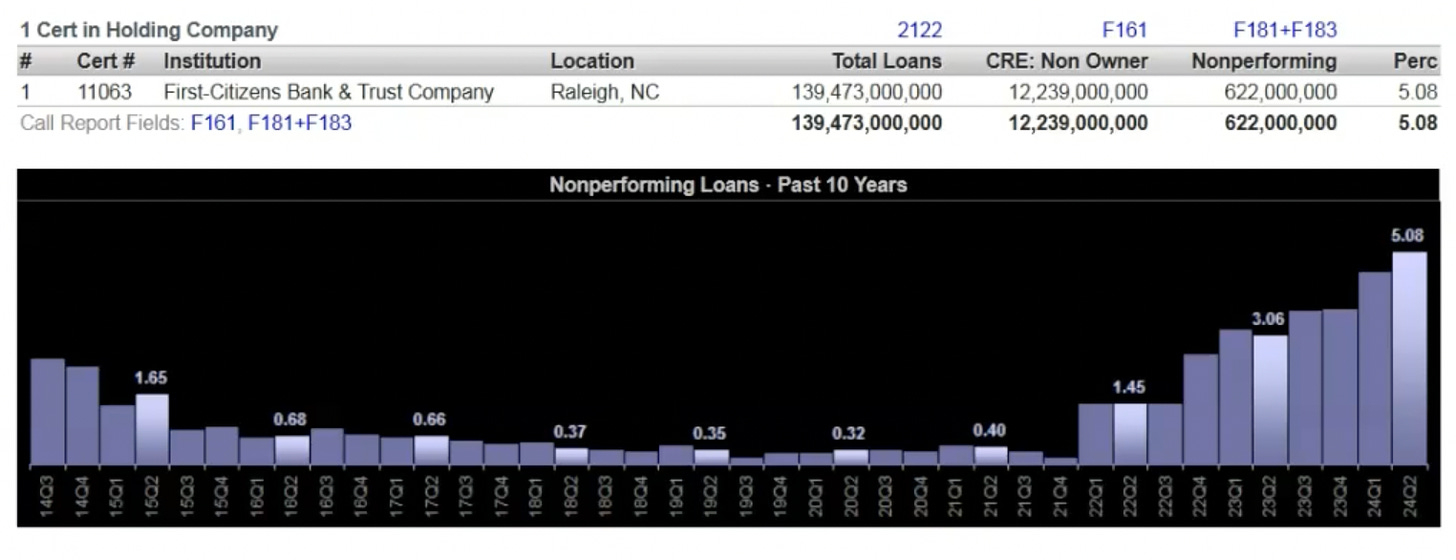

Through consistent underwriting profits and sound acquisitions, Holding has developed First Citizens into the nation’s top-performing bank; no easy feat considering the competition. Though, an important question is: Why is this regional player winning by such a wide margin? The answer is their roughly $30 billion of low-cost funding from the FDIC; borrowing at 3.5% and lending to the Fed at 5%.

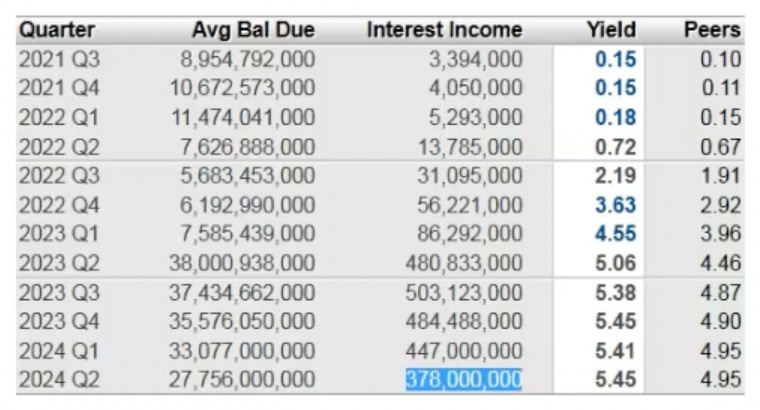

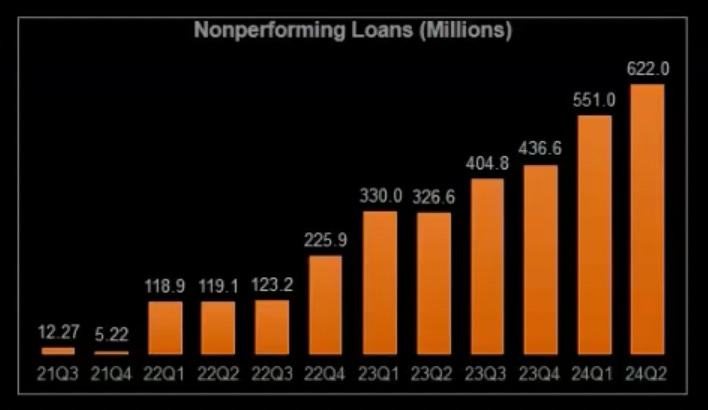

While this is a huge advantage for them; I don’t think short/medium-term funding makes them an enduring “top-performer”, but over-reliant on the Fed, as these assets make up roughly 15% of their book. Moreover, the quality and culture of their business is waning, considering the data:

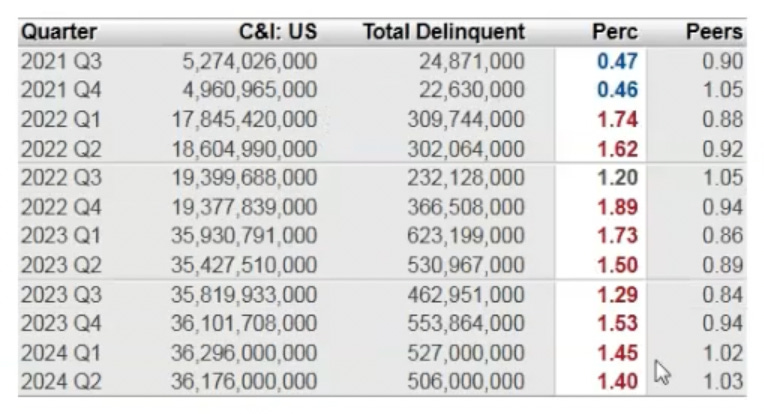

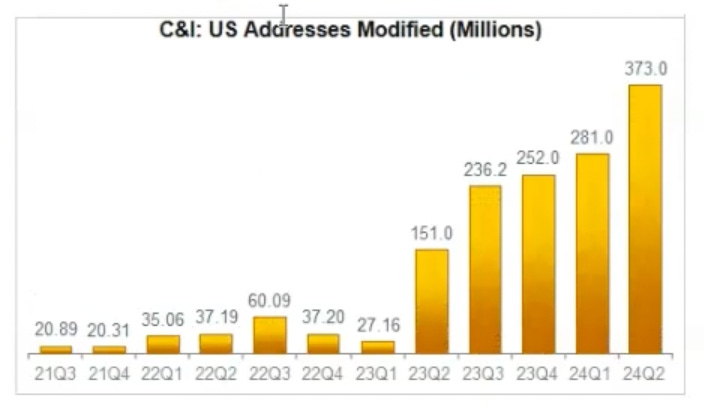

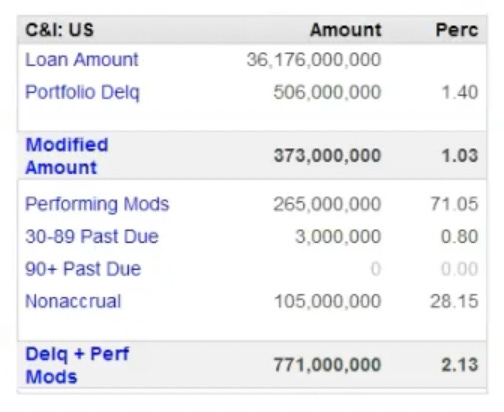

At first glance, C&I delinquencies seem to be decreasing, but that is because of the surge in “performing” modifications.

The 1.40% is actually 2.13%.

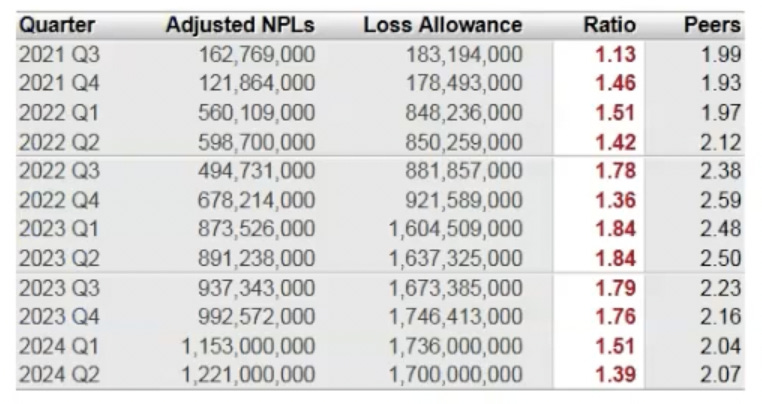

Lastly, they are not well reserved. They’re keeping a lower provision for losses, reporting a much higher amount of income than appropriate, which is rather confusing given their adequately capitalized balance sheet.

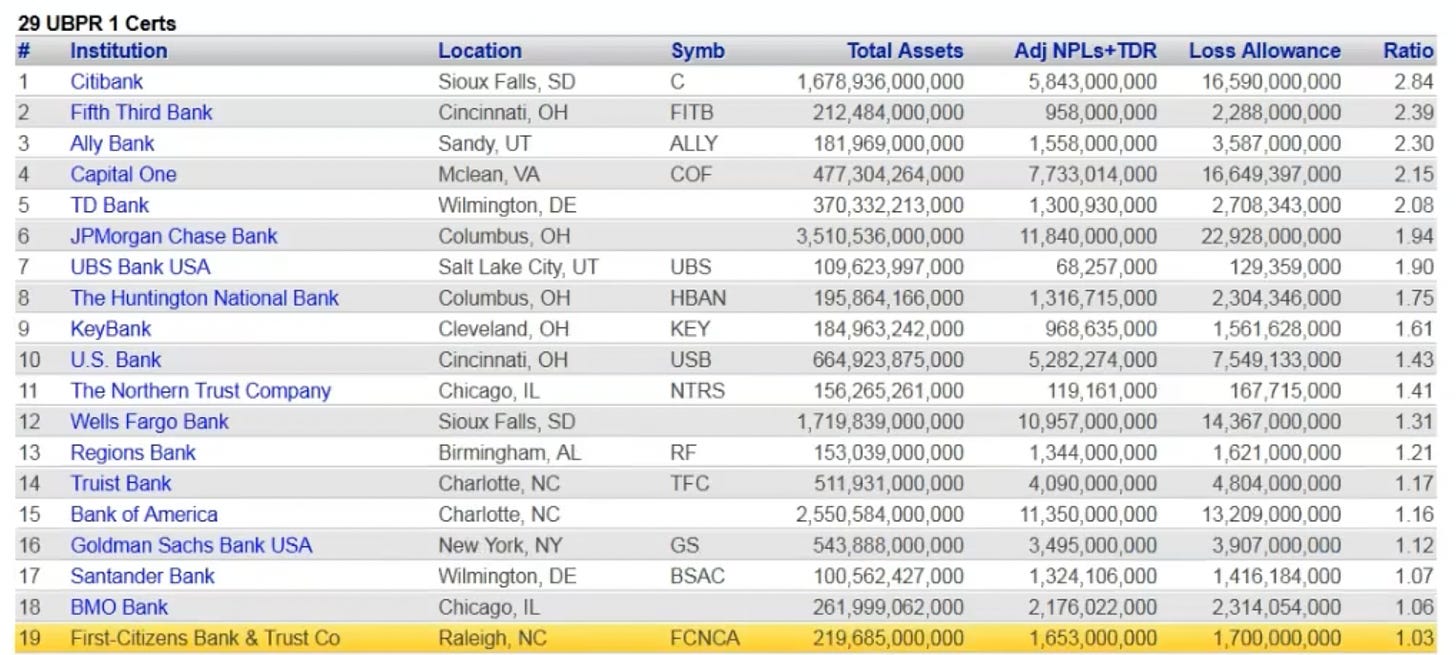

FCNCA is ranked #19 on this list, so it’s not surprising they are the top-performing bank; earnings can be created with a stroke of a pen. As their loan quality continues to degrade, these losses will have to work their way through the income statement.

Also, notice Bank of America at #16, which Berkshire Hathaway has been selling.

First Citizens is a fine bank with a great track record, but I think there are near-term headwinds the market isn’t properly discounting (i.e. lower interest rates + degrading credits). It’s easy to get seduced by a management team touting buybacks that could acquire a third of the market cap, but the aforementioned metrics are considerably alarming. Moreover, I disagree with such a large buyback given the deterioration of their book.

I am not sure that this is right.

The bad loans don't come from a cultural change. They come from the acquisition of CIT at a big discount closing over two years ago.